Requesting money transfers to U.S. customers

Current money transfer options from the U.S. to Central America lack user-friendly interfaces, transparency in fees, and efficient processing times. Users often encounter difficulty navigating through the process, leading to frustration and a lack of trust in the system.

Project Details

Company

Namutek

Project type

Contract

Project Date

2023

My role

Lead UX Designer, collaborating with Dev, Product and Executive team.

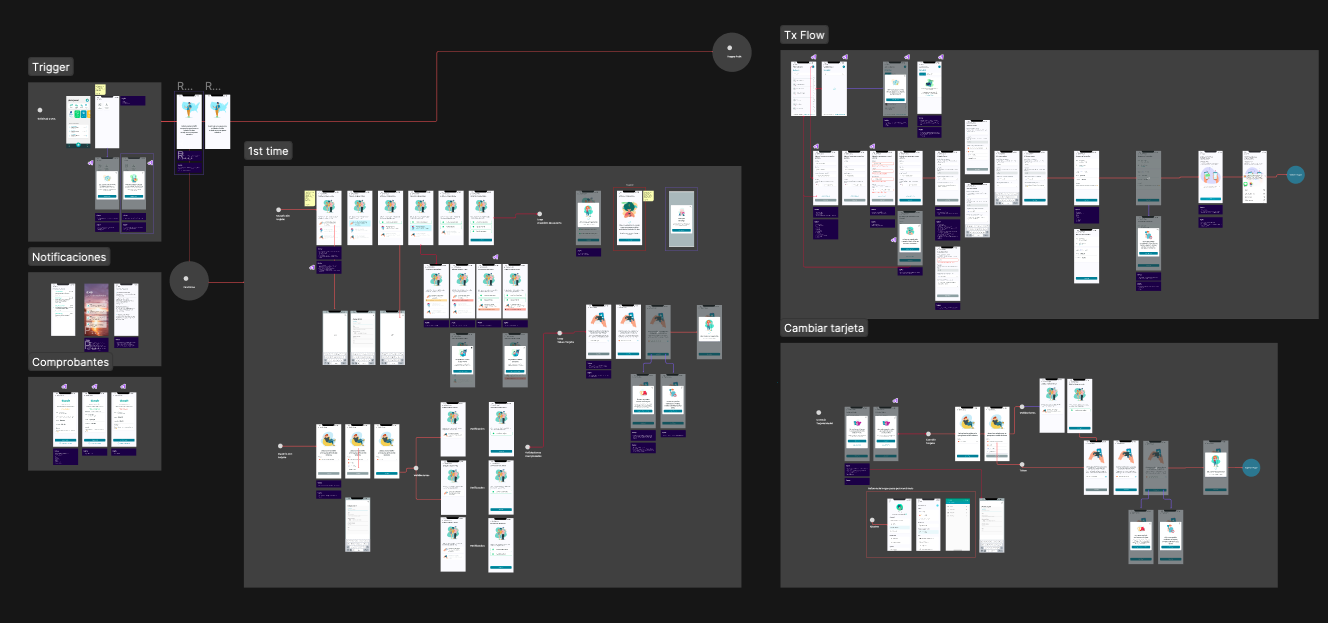

High-level User Flow

Project Objectives

Create an intuitive and accessible money transfer feature for users in Central America to receive funds from the U.S.

Establish transparency in terms of exchange rates, fees, and estimated delivery times.

Ensure compliance with international financial regulations and security standards.

Build trust among users through clear communication and a seamless transaction experience.

The Challenge

Kash has a unique opportunity to establish a strong presence in the remittance market, facilitating money transfers from the USA to Central America. To seize this opportunity, Kash has formed a strategic alliance with a new partner based in the USA. This alliance empowers Kash to offer a seamless and efficient service for sending money from the USA to countries within the Central American region.

Business Risks & Constraints

-

Users must complete several steps to be able to request money the first time they use the feature. This may lead to abandonment.

-

Only 11% of users are verified through Microdeposits, KYC and have a card on file. These are not considered MAU’s

-

No window for user research, testing or competitive analysis by business decision

-

Kash is not a U.S. based app, and senders might be hesitant to use it.

-

The experience of sending the money to Central America occurs in a 3rd party platform not monitored or controlled by Kash.

-

Kash depends of local banks approvals that require a lot of investigation, international regulations, and approvals.

About Kash

-

Kash is a P2P Payments application focused on added value service. Multi-bank app servicing Costa Rica, Guatemala, Honduras, Nicaragua, Panamá and El Salvador. Kash is the first application in the region that uses Visa Direct and Mastercard Send technologies. It also integrates other services for money transfer that help users move money easily, fast and securely.

-

Mobile App: Android and iOS

React native

-

Families and Recipients: Families and recipients of remittances rely on the app to receive money sent by their loved ones working abroad.

Migrant Workers: Many Central American countries have citizens working abroad. Migrant workers use the app to send money back to their families and loved ones in their home countries.

Business Owners: Small business owners use the app to receive payments from customers and suppliers, enabling seamless transactions and better cash flow management.

Freelancers and Gig Workers: Individuals working as freelancers or participating in gig economy jobs use the app to receive payments for their services from clients.

Design Process

I began by collecting all user insights, defining the correct user flow and technical requirements in collaboration with the Product Owner, and constantly meeting with the Business Partner to document and incorporate their requirements and user flow into Kash’s experience.

An essential step involved collaborating with legal experts to ensure our designs complied with international money transfer regulations and rigorous data security standards. The goal was to create designs that not only met user needs but also adhered to the legal framework governing our industry.

User Flow - Inside the App and Outside Processes

The Solution

The experience begins by making a money request to an individual in the United States. Kash users can request up to $X amount in US dollars. There are daily and monthly limits for both the requested amount of money and the number of monthly requests.

First time Users

SCENARIO 1

If it's the user's first attempt at this option, the system must verify if the user meets the minimum requirements established by the business: Added Card, Micro-deposit Verification, KYC Verification.

If these requirements are not met, the system will inform the user that they need to complete these verifications and guide them through the process.

Once the user has completed the initial verifications, the system can create the user on the partner platform. This process can take up to 48 hours.

After the process is complete, the application should notify the user that they can now proceed with their request.

SCENARIO 2

Happy path

A user who has already gone through the verification and user creation processes will have a simpler experience in this process.

The user can select the person from their contacts to whom they want to request money or enter a new contact.

Next, they should enter the amount of money they want to request from their contact, and the system will automatically calculate the commission for the received money.

Additionally, they can select the card where the money will be deposited and include a personalized message for their contact.

The user will have the ability to review their request before sending it to ensure that all the data is correct.

Once the request is sent, the application will share a payment link that the user can share with their contact through their preferred method.

The rest of the experience for this flow happens on the business partner's side.

Metrics & Errors

-

Number of Successful Requests

Number of Requests Sent vs. Completed

Time Between Request Sent and Completed

How Many Users Abandon During Validation?

Number of Validated Users Who Complete the Happy Path

Number of Users Successfully Completing Micro-deposit after Validation

Average Requested Amount

Average Received Amount

Usage Statistics - Characteristics of Users Making Requests

Usage Statistics - Characteristics of Users Being Requested Money: Location by Phone Number.

-

Monthly Request Limit Reached: The user must try again in the following month.

Contact Already Added: The user has previously added the contact's details and should locate it in their directory.

Time-out Error: No response from the system, prompting the user to try again later.

Monthly Request Limit: Displayed when the user has reached the monthly request limit within the application. The user should retry on the next 1st of the month.

Daily Request Limit: Shown when the user has sent more than X (amount per business) daily requests, limiting to prevent fraud attempts. The user should try again after 24 hours.

Card Validation: The user needs to contact support for card validation. Card Validation (Time-Out): Timeout error during the validation process. The user should retry later.

Identity Validation: The user needs to contact support for identity validation.

Contact Search: The user performs a contact search from the contacts screen and doesn't find the contact.

Results & Designs

After the development of this new functionality, a beta version was launched in June 2023, allowing a controlled group of 10 users to conduct usability tests.

An early “User Validation” strategy was implemented to increase the percentage of users who completed the various security validations required by the app. This percentage increased from 11% to 43%.

Additionally, a "Add Card" campaign was implemented in the app, encouraging users who hadn't added their cards to do so before the implementation of this functionality. This resulted in an 8% increase in card additions.

This new feature not only increases app usage but also enables Kash to monetize through a commission-based model for receiving money from users. Furthermore, it positions Kash in a broader market, tapping into a new target audience of "Migrant workers" who will send money through the Business Partner feature.

First time user

Compliance verification

Documented flows in Design Files

Edge cases

How to change your card

Overall flow

Requesting Money

A word from my manager,

Laura is simply outstanding... one of those shiny professionals that not only has a very positive attitude to challenges and is always willing to give the extra mile, but also detailed in regards to design, knowledgeable about UX.

It is easy for teams to work with Laura and for Laura to quickly become a key player in any team she is to operate with. I enjoyed all interactions with Laura, learned from those, was able to team up with her to set up goals and execute, was impressed by all her energy and good ideas in brainstorming sessions.

Finally, though her passion is on UX and Design, her scope and range is much more ample and has the EQ and leadership to bring products and teams to high levels of performance.

Diego May

Former CEO